CASE STUDY: Small Fleet, Big Retention Impact

Consider this real-world example from a 15-truck regional carrier:

The Problem: 85% annual driver turnover, three preventable accidents in 12 months, insurance premiums increasing 40% at renewal.

The Intervention:

- Increased driver pay by 12% to match top regional competitors

- Guaranteed all drivers home every weekend

- Implemented a driver mentoring program

- Upgraded to trucks less than 5 years old

- Created a safety bonus program with quarterly payouts

- Installed comprehensive dash cam systems

The Results After 18 Months:

- Driver turnover dropped to 35%

- Average driver tenure increased from 11 months to 28 months

- Zero preventable accidents

- Insurance premiums decreased 15% despite market-wide increases

- Customer complaints about inconsistent service disappeared

- Driver referrals became the primary source of new hires

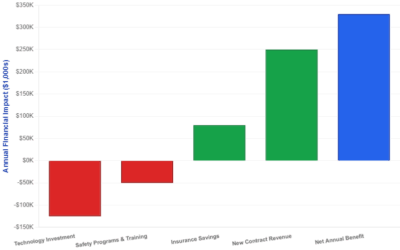

The ROI:

- Retention initiatives cost approximately $85,000 annually

- Insurance savings: $22,000 annually

- Reduced recruiting and training costs: $65,000 annually

- Eliminated downtime from unseated trucks: $40,000 annually

- Improved customer retention: immeasurable but significant

- Net benefit: $127,000+ annually

Measuring Retention Impact on Insurance

To leverage retention as an insurance strategy, you need to measure and document it:

Metrics to Track

- Average driver tenure (target: 3+ years)

- Turnover rate by quarter (target: below 50% annually)

- Accidents per driver by tenure cohort

- Safety violations by driver experience level

- CSA scores correlated with driver tenure

- Customer satisfaction scores by driver

Documentation for Insurers

Create a retention and safety portfolio that includes:

- Driver tenure statistics showing improvement trends

- Comparison of safety performance by experience level

- Retention program descriptions and investment levels

- Driver satisfaction surveys and results

- Mentoring program structure and outcomes

- Career development opportunities offered

Share this documentation with your insurance agent during renewal. Make it easy for underwriters to see that your retention strategy is a deliberate risk management approach.

The Virtuous Cycle

Here’s what makes driver retention so powerful: it creates a self-reinforcing positive cycle.

Better retention leads to: → More experienced drivers → Fewer accidents and violations → Lower insurance premiums → More resources available for driver compensation and benefits → Even better retention → Continued improvement in safety and costs

Conversely, the negative cycle of high turnover is hard to escape: → Constant new drivers → More accidents and incidents → Rising insurance premiums → Less money available for driver compensation → Even higher turnover → Continued deterioration

The question is: which cycle is your company in?

Taking Action: Your 90-Day Retention and Insurance Plan

Days 1-30: Assessment

- Calculate your true turnover cost (including insurance impact)

- Survey drivers about satisfaction and concerns

- Analyze accident data by driver tenure

- Review current compensation against market rates

- Document your existing retention programs

Days 31-60: Implementation

- Address the top 3 driver concerns identified in surveys

- Implement or improve at least one major retention initiative

- Launch or enhance your driver recognition program

- Create career development pathways

- Begin documenting retention efforts for insurers

Days 61-90: Documentation and Communication

- Compile retention statistics and trends

- Document new programs and initiatives

- Create comparison data showing safety by driver experience

- Share retention strategy with insurance agent

- Request updated quotes reflecting improved retention

The Bottom Line

Most carriers view driver retention and insurance costs as separate challenges. But they’re intimately connected.

Every time you lose an experienced driver and replace them with a new hire, you’re not just spending $11,000 to $32,000 on recruitment and training. You’re also increasing your insurance risk and, ultimately, your premiums.

Conversely, every driver who stays with your company for years instead of months makes your entire operation safer, more efficient, and more attractive to insurance underwriters.

The carriers with the best insurance rates aren’t necessarily the ones shopping most aggressively—they’re the ones who’ve built operations where drivers want to stay.

In 2025’s challenging insurance market, driver retention isn’t just an HR initiative. It’s a core risk management and insurance cost reduction strategy.

The question is: are you treating it that way?